Reliability Calculator

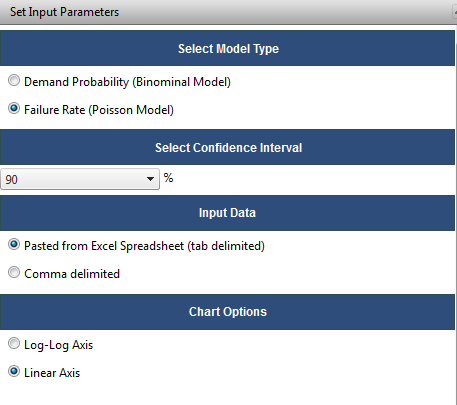

The U. S. Nuclear Regulatory Commission (NRC) in conjunction with the Idaho National Laboratory (INL) developed software to evaluate data for use in Probabilistic Risk Assessments (PRA).

The software uses US commercial nuclear power plant data and statistical routines to provide statistical analysis of the data.

The Reliability Calculator uses these statistical routines to allow risk analysts to statistically analyze their own data and is available to the public.

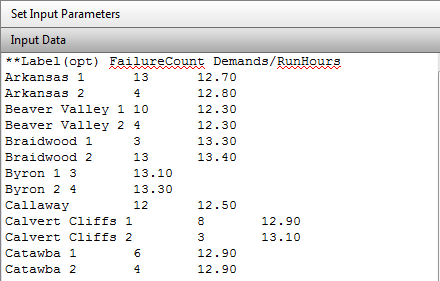

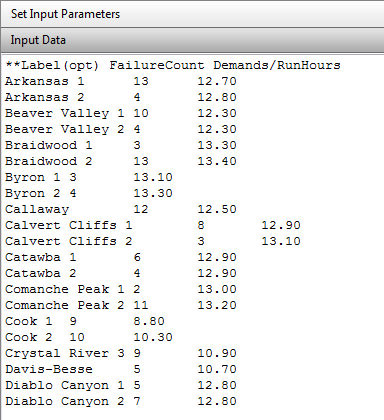

The Reliability Calculator analyzes two basic types of data; ‘Un-partitioned Data’ and ‘Partitioned Data’.

- Un-partitioned Data is data that the analyst only knows the total failures (events) and total demands (run hours).

- Partitioned Data is data that has been kept at some level of detail and should consist of a list of pairs of failures (events) and demands (run hours). These pairs can be rolled up from more detailed data—as in trending data which would be a pair summed over the year.

Analysis of Un-partitioned Data

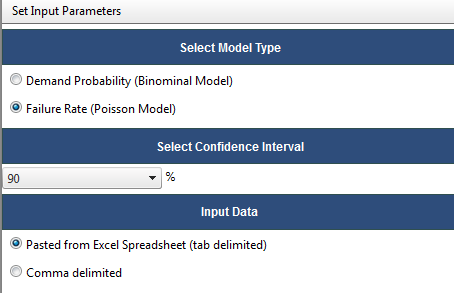

Two types of un-partitioned analyses are provided: Classical and Bayesian Update.

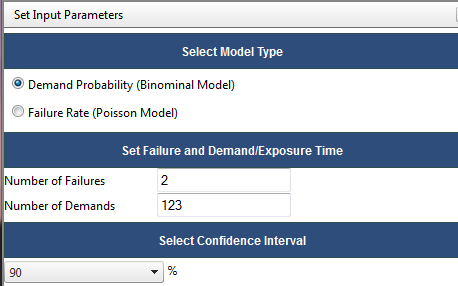

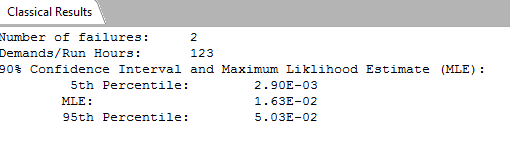

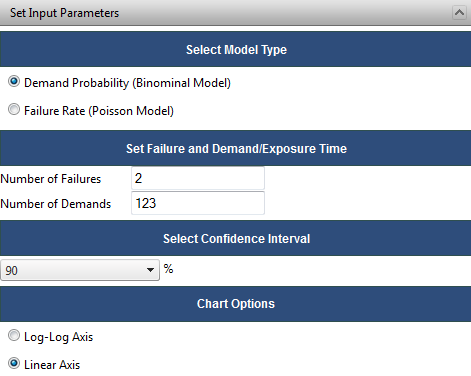

Calculate Classical

Demand. Suppose that similar components or systems are repeatedly demanded, that the success or failure on any demand is independent of the outcomes on other demands, and that the probability of failure on any demand is p, the same for all demands. Under these assumptions, the number of failures in n demands, X, is a random variable with a binomial(n, p) distribution.

Rate. Suppose that one or more similar components or systems are observed over time, that events, such as failures, occur randomly. Suppose further, that exactly simultaneous events do not occur, and that the probability of an event in a time interval of length Dt is approximately lDt, with l unchanging. Finally, suppose that event occurrences in disjoint time periods are independent. Under these assumptions, the number of failures in time t is a random variable with a Poisson(lt) distribution.

Select the appropriate model type, enter the failures and demands (or time), and select a confidence interval. Based on the above assumptions, the classical calculation results in a maximum likelihood (MLE) estimator and a confidence interval.

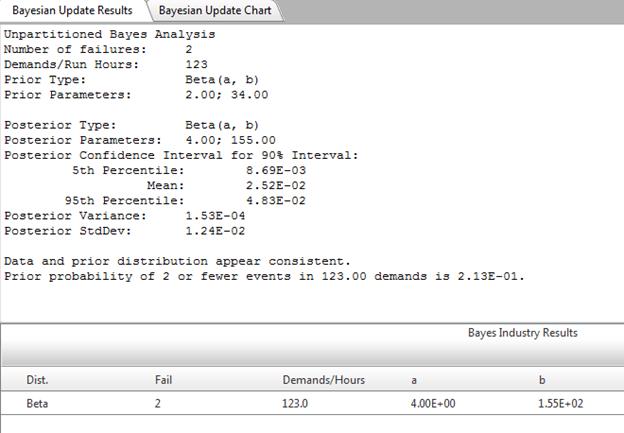

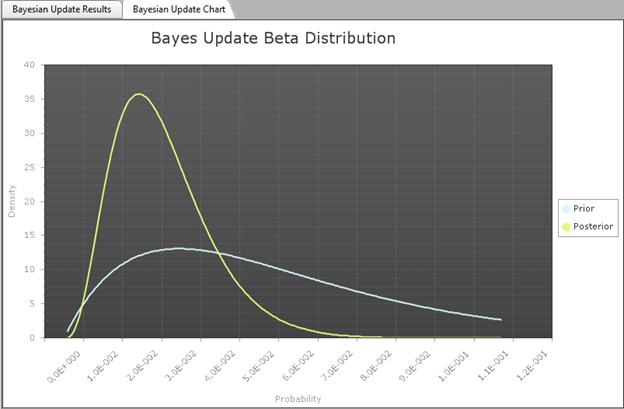

Bayes Update of Un-Partitioned Data

The Bayes menu item allows the user to perform a Bayes estimate. The results of the analysis are based upon the prior distribution of the Jeffreys noninformative distribution, a user-supplied distribution, or a distribution selected from the Distribution bank.

Bayes Estimation of p

Suppose that similar components or systems are repeatedly demanded, and that the following statements are true.

1. The probability of failure on any demand is p, the same for all demands.

2. The success or failure on any demand is independent of the outcomes on other demands.

Under these assumptions, the number of failures in n demands, X, is a random variable with a binomial(n, p) distribution. RADS performs some statistical checks on the plausibility of these assumptions.

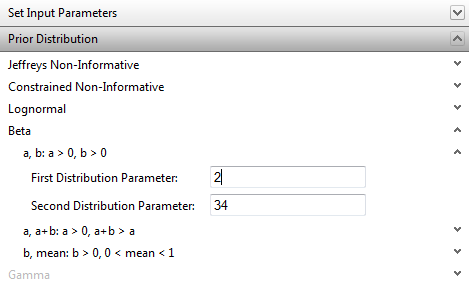

Bayesian estimation measures uncertainty in p by a probability distribution. It assumes some prior distribution for p, corresponding to uncertainty in p before taking the present data into account. Five forms of the prior distribution are allowed.

· A beta distribution. The user may specify the distribution by inputting the two standard parameters, or by inputting the mean and one of the standard parameters.

· The Jeffreys noninformative distribution. This is a beta distribution with parameters ½ and ½.

· A (beta approximation of the) constrained noninformative prior distribution. The user must input the mean, and RADS will calculate the dispersion automatically, corresponding in a specific sense to no information other than the mean.

· A lognormal distribution. The user may specify the distribution by inputting the mean and standard deviation of the underlying normal distribution or the mean and error factor of the lognormal distribution, or the median and error factor of the lognormal distribution. RADS prints a warning if the specified distribution causes Pr(p > 1) to be > 0.001.

RADS then checks to see if the data (x failures in n demands) are consistent with the prior distribution. That is, if x/n is less than the prior mean, RADS calculates

![]()

where f is the prior density. If, instead, x/n is greater than the prior mean, RADS calculates

![]()

In either case, if the calculated integral is 0.025 or smaller, RADS prints a warning message that the data and the prior distribution appear to be inconsistent. The user is given the choice of continuing or specifying a new prior distribution.

RADS then calculates the posterior distribution, and presents selected percentiles of the distribution, as well as the posterior mean, variance, and standard deviation.

If the prior distribution is a beta distribution, the posterior distribution is also a beta distribution, and all of the calculations are performed algebraically. If the prior distribution is not a beta distribution, all the calculations use numerical integration.

For more information on Bayes estimation of p when using a beta prior, see Atwood (1994) (Ref 3), Box and Tiao (1973) (Ref [1]), or Martz and Waller (1991) (Ref 6).

Bayesian Estimation of Lambda

Suppose that one or more similar components or systems are observed over time, that events, such as failures, occur randomly. Suppose further:

1. The probability of an event in a time interval of length Dt is approximately lDt, with l unchanging.

2. Exactly simultaneous events do not occur.

3. Event occurrences in disjoint time periods are independent.

Under these assumptions, the number of failures in time t is a random variable with a Poisson(lt) distribution. RADS performs some statistical checks on the plausibility of these assumptions.

Bayesian estimation measures uncertainty in l by a probability distribution. It assumes some prior distribution for l, corresponding to uncertainty in l before taking the present data into account. Four forms of the prior distribution are allowed.

1. A gamma distribution. The user may specify the distribution by inputting the two standard parameters, or by inputting the mean and one of the standard parameters.

2. The Jeffreys noninformative distribution. This is an improper distribution (that is, it has an infinite integral), proportional to λ-1/2 . However, in may be treated algebraically as if it were a gamma distribution with parameters 1/2 and 0.

3. A constrained noninformative prior distribution. This is also a gamma distribution. The user must input the mean, and RADS will calculate the dispersion automatically, corresponding in a specific sense to no information other than the mean.

4. A lognormal distribution. The user may specify the distribution by inputting the mean and standard deviation of the underlying normal distribution or the mean and error factor of the lognormal distribution, or the median and error factor of the lognormal distribution.

RADS then checks to see if the data (x events in time t) are consistent with the prior distribution. That is, if x/t is less than the prior mean, RADS calculates

![]() ,

,

where f is the prior density. If, instead, x/n is greater than the prior mean, RADS calculates

![]() .

.

In either case, if the calculated integral is 0.025 or smaller, RADS prints a warning message that the data and the prior distribution appear to be inconsistent. The user is given the choice of continuing or specifying a new prior distribution.

RADS then calculates the posterior distribution, and presents selected percentiles of the distribution, as well as the posterior mean, variance, and standard deviation.

If the prior distribution is a gamma distribution, the posterior distribution is also a gamma distribution, and all of the calculations are performed algebraically. If the prior distribution is not a gamma distribution, all the calculations use numerical integration.

For more information on Bayes estimation of lambda when using a gamma prior, see Engelhardt (1994) (Ref [2]), Box and Tiao (1973) (Ref 1), or Martz and Waller (1991) (Ref 6).

Analysis of Partitioned Data

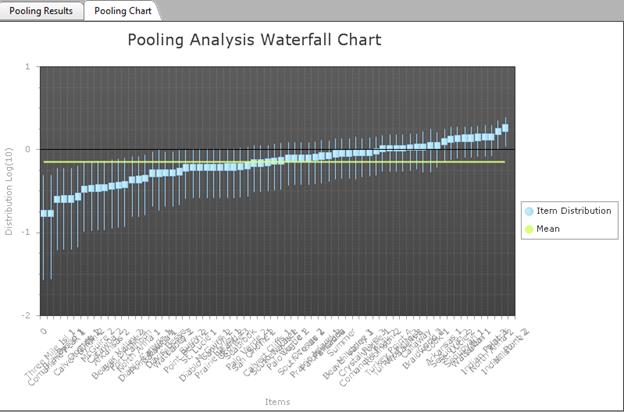

Pooling

Consider random counts that correspond to cells, so that every cell gets some count. For example, the counts could be numbers of failures or successes, and a cell might correspond to failures at a particular plant, or successes of a particular system, or failures during some time period. For more details, see the explanations for testing poolability when estimating p or estimating l. Let ni denote the count for cell i. A hypothesis, Ho is to be tested, such as the hypothesis that all the failures on demand have the same probability or that all the events in time occur with the same frequency. These two example hypotheses each involve an unknown parameter, the failure probability and the event frequency, respectively. In general, the hypothesis to be tested typically involves one or more unknown parameters.

Estimate the unknown parameter(s) from the count data, and

calculate the expected count for each cell if the hypothesis is true. Denote

the expected count for cell i by ![]() . The difference

between the observed count and the expected count for any cell is

. The difference

between the observed count and the expected count for any cell is ![]() . There are many

cells, and therefore many ways of combining the differences to yield an overall

number. One useful way is to construct

. There are many

cells, and therefore many ways of combining the differences to yield an overall

number. One useful way is to construct

![]() ,

,

called the chi-squared statistic, or sometimes the Pearson

chi-squared statistic after its inventor, Karl Pearson. If the observed counts

![]() are far from the expected

values

are far from the expected

values ![]() , the evidence against

Ho is strong. Therefore, Ho should be

rejected if

, the evidence against

Ho is strong. Therefore, Ho should be

rejected if ![]() is large, and not

rejected if

is large, and not

rejected if ![]() is small.

is small.

How large or small must ![]() be? As the counts

become large,

be? As the counts

become large, ![]() has approximately a

chi-squared distribution. To calculate the degrees of freedom, treat any

demand counts as nonrandom. The degrees of freedom is the number of

independent counts, minus the number of estimated parameters under Ho.

Reject Ho if

has approximately a

chi-squared distribution. To calculate the degrees of freedom, treat any

demand counts as nonrandom. The degrees of freedom is the number of

independent counts, minus the number of estimated parameters under Ho.

Reject Ho if ![]() is in the right tail

of the chi-squared distribution, for example beyond the 95th

percentile.

is in the right tail

of the chi-squared distribution, for example beyond the 95th

percentile.

The chi-squared approximation is valid if the data set is

large. RADS gives a mild warning if any of the expected values ![]() are less than 1.0,

and a stronger warning if any of the

are less than 1.0,

and a stronger warning if any of the ![]() values are less than

0.5. These warnings agree with standard published rules of thumb.

values are less than

0.5. These warnings agree with standard published rules of thumb.

This test for poolability does not use any ordering of the cells. Thus, tests that are specifically designed to detect trends may be more suited to analysis of differences between time periods.

Testing for Homogeneity (Poolability) When Estimating p

In the typical RADS application, two attributes of any event

are (a) whether it is a failure or success and (b) the source of the data ¾ the plant, the system, the year, or the

type of demand. RADS constructs a table with two columns and R rows.

The columns correspond to failures and successes, respectively, and the R

rows correspond to the R sources of data. Denote the count in the ith

row and jth column by ![]() , for i any

number from 1 to R and j equal to 1 or 2. The number of failures

for row i is

, for i any

number from 1 to R and j equal to 1 or 2. The number of failures

for row i is ![]() and the number of

successes is

and the number of

successes is ![]() . The number of

demands is

. The number of

demands is ![]() . Similarly, let

. Similarly, let ![]() be the total number

of failures in all rows, let

be the total number

of failures in all rows, let ![]() be the total number

of successes, and let

be the total number

of successes, and let ![]() be the grand total

number of demands.

be the grand total

number of demands.

The hypothesis of poolability is that all the rows

correspond to the same probability of failure on demand. The natural estimate

of this probability is ![]() . If the data sources

can be pooled, the expected number of failures for row i is

. If the data sources

can be pooled, the expected number of failures for row i is ![]() , and the expected

number of successes is

, and the expected

number of successes is ![]() . The Pearson

chi-squared statistic is defined as

. The Pearson

chi-squared statistic is defined as

![]()

If the observed counts are far from the expected counts, the

evidence against poolability is strong. The existence of observed counts that

are far from the expected counts causes ![]() to be large.

Therefore, poolability is rejected when

to be large.

Therefore, poolability is rejected when ![]() is large. When the

sample size is large,

is large. When the

sample size is large, ![]() has approximately a

chi-squared distribution with R -

1 degrees of freedom. So poolability is rejected with p-value 0.05 if

has approximately a

chi-squared distribution with R -

1 degrees of freedom. So poolability is rejected with p-value 0.05 if ![]() is larger than the

95th percentile of the chi-squared distribution, with p-value 0.01 if

is larger than the

95th percentile of the chi-squared distribution, with p-value 0.01 if ![]() is larger than the

99th percentile, and so forth.

is larger than the

99th percentile, and so forth.

The contribution to ![]() from row i is

from row i is

![]() .

.

Inspection of these terms shows which rows show the most deviation from the overall average, in the sense of the chi-squared test. They can help show in what ways poolability is violated. In RADS the signed square root of this term is shown, with a positive sign if the number of failures is higher than expected, and a negative sign if the number of failures is lower than expected. These signed square roots are called the "Pearson residuals."

If the data set is small (few failures or few successes) the

chi-squared approximation is not very good. RADS gives a mild warning if any

of the expected values ![]() are less than 1.0,

and a stronger warning if any of the

are less than 1.0,

and a stronger warning if any of the ![]() values are less than

0.5. These warnings agree with standard published rules of thumb.

values are less than

0.5. These warnings agree with standard published rules of thumb.

For more information, see Atwood (1994) (Ref 3)

Testing for Homogeneity (Poolability) When Estimating Lambda

In the typical RADS application, various sources of the data

¾ plants, systems, years, or types of

discovery activity ¾ each correspond to

a count of events (such as initiating events or system demands) and an exposure

time, such as calendar years or critical hours. RADS constructs a table with C

cells, each cell corresponding to one source of data. The ith

cell contains a count, ni, the number of events reported for

that source of data during exposure time ![]() . Denote the total

number of events in all the data by

. Denote the total

number of events in all the data by ![]() , and denote the total

exposure time by

, and denote the total

exposure time by ![]() .

.

The hypothesis of poolability is that all the cells

correspond to the same event frequency. The natural estimate of this frequency

is ![]() . If the data

sources can be pooled, the expected number of events for cell i is

. If the data

sources can be pooled, the expected number of events for cell i is ![]() . The Pearson

chi-squared statistic is defined as

. The Pearson

chi-squared statistic is defined as

![]() .

.

If the observed counts are far from the expected counts, the

evidence against poolability is strong. The existence of observed counts that

are far from the expected counts causes

![]() to be large.

Therefore, poolability is rejected when

to be large.

Therefore, poolability is rejected when ![]() is large. When the

sample size is large,

is large. When the

sample size is large, ![]() has approximately a

chi-squared distribution with C -

1 degrees of freedom. So poolability is rejected with p-value 0.05 if

has approximately a

chi-squared distribution with C -

1 degrees of freedom. So poolability is rejected with p-value 0.05 if ![]() is larger than the

95th percentile of the chi-squared distribution, with p-value 0.01 if

is larger than the

95th percentile of the chi-squared distribution, with p-value 0.01 if ![]() is larger than the

99th percentile, and so forth.

is larger than the

99th percentile, and so forth.

The contribution to ![]() from row i is

from row i is

![]() .

.

Inspection of these terms shows which cells show the most

deviation from the overall average, in the sense of the chi-squared test. They

can help show in what ways poolability is violated. RADS shows the signed

square root of these terms,![]() . They are called the

"Pearson residuals".

. They are called the

"Pearson residuals".

If the data set is small (few events) the chi-squared

approximation is not very good. RADS gives a mild warning if any of the

expected values ![]() are less than 1.0, and

a stronger warning if any of the

are less than 1.0, and

a stronger warning if any of the ![]() values are less than

0.5. These warnings agree with standard published rules of thumb.

values are less than

0.5. These warnings agree with standard published rules of thumb.

For more information, see Engelhardt (1994) (Ref 2).

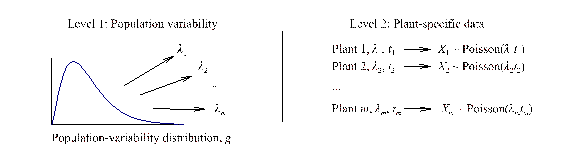

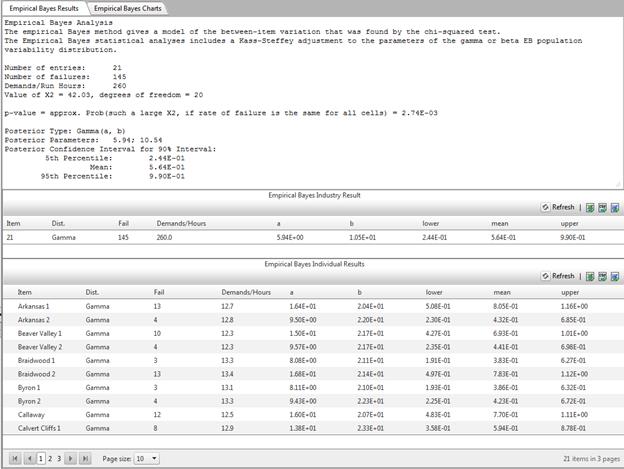

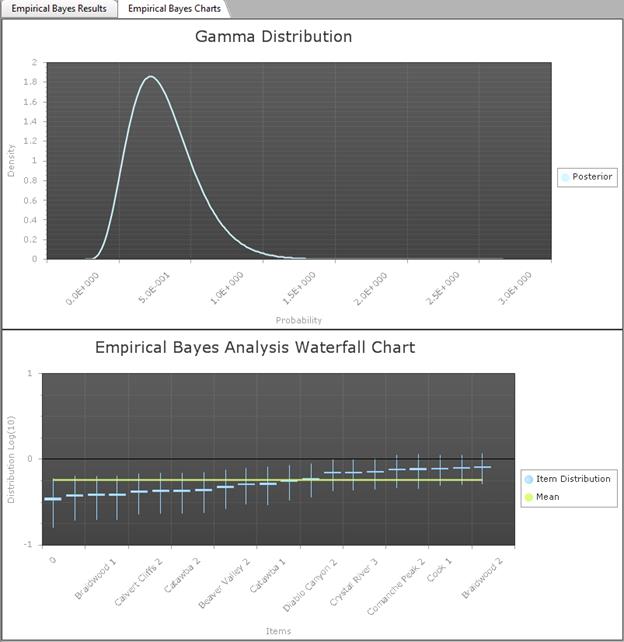

Empirical Bayes

Empirical Bayes estimation is used when the parameter varies. For example, p or Lambda may be different at different plants. It is assumed that the plant-specific parameter is generated randomly from some population-variability distribution. Once the parameter has been generated for a specific plant, data at that plant are randomly produced, with a distribution governed by the plant-specific parameter. This hierarchical model is illustrated for Poisson data in the figure below, with the plant-specific parameters generated at one level and the data for each plant generated at the next level.

Hierarchical model for Poisson data

The distribution g involves unknown parameters. If g is a conjugate distribution (a gamma distribution for lambda, or a beta distribution for p), the empiric al Bayes method estimates the two unknown parameters of g from the data, using maximum likelihood estimation.

Empirical Bayes Estimation of p

Suppose that the data for failures on demand have been partitioned into distinct data sources, such as distinct plants or systems. For concreteness, the model is explained here assuming that the distinct data sources are plants. Each plant corresponds to an observed number of demands, say ni demands for the ith plant. The number of failures for that plant is assumed to be a binomial(ni, p) random variable.

Suppose that p is believed to vary from plant to plant. For example, the chi-square test may have rejected the hypothesis of a constant p, or engineering considerations may suggest that p is not constant. What model should be used?

One approach is to analyze each plant separately, resulting in a separate estimate of p for each plant. This is reasonable if there are only two plants. It might also be reasonable if one plant is clearly different from all the others. In this case, the one plant could be analyzed separately, and all the other plants might be considered as a single homogeneous source. After this regrouping of the data, only two data sources exist, to be analyzed separately.

Often, however, removal of one outlier leaves a data set that contains another outlier, and removal of that may leave a set with still another outlier. In such cases it is simpler (that is, it involves fewer parameters to estimate) to use the following compound model.

The method models the variation between the plants, using a population-variability distribution. It is

assumed that p varies from plant to plant, and follows a beta(a, b) distribution. Let ![]() denote the value

corresponding to the ith plant. At this plant,

conditional on the value of

denote the value

corresponding to the ith plant. At this plant,

conditional on the value of ![]() , it is assumed that

each demand results in a failure with probability

, it is assumed that

each demand results in a failure with probability ![]() . In short, the

number of failures in n demands at the ith

plant is binomial(n,

. In short, the

number of failures in n demands at the ith

plant is binomial(n, ![]() ); the number of

failures in n demands at a single random plant has a

beta-binomial(n, a, b) distribution. The value of n

is known, and the two parameters a and b are unknown.

); the number of

failures in n demands at a single random plant has a

beta-binomial(n, a, b) distribution. The value of n

is known, and the two parameters a and b are unknown.

RADS uses numerical iteration to find the maximum likelihood estimates of a and b.

The iterative procedure does not always converge. In some cases, the search for the maximum likelihood leads to a/(a+b) stabilizing at a finite value but a+b diverging to infinity. RADS stops the numerical search whenever a+b appears to be larger than the total number of trials in the data set; such a large value for a+b should not be used because it would result in plant-specific intervals shorter than the interval based on simply pooling all the data. In this case RADS states that the empirical Bayes distribution is degenerate, concentrated at a single point.

Suppose now that finite values of a and b have

been estimated, giving an estimated overall distribution of p. We now

naturally inquire about the value of ![]() at the ith

plant. The model says that

at the ith

plant. The model says that ![]() was randomly selected

from the beta(a, b) distribution, and the

was randomly selected

from the beta(a, b) distribution, and the ![]() failures in ni

demands were generated from a binomial(

failures in ni

demands were generated from a binomial(![]() ,

,![]() ) distribution.

Recall that a and b are estimated. The simplest approach is to

act as if the estimates were the true values. For the ith

data source, let the prior distribution of

) distribution.

Recall that a and b are estimated. The simplest approach is to

act as if the estimates were the true values. For the ith

data source, let the prior distribution of ![]() be beta(a, b),

and find the posterior distribution of

be beta(a, b),

and find the posterior distribution of ![]() by updating the prior

with the data. This is the usual Bayes method for

estimating , except that the

prior parameters are estimated from all the data. This leads to the name

"empirical Bayes estimation."

by updating the prior

with the data. This is the usual Bayes method for

estimating , except that the

prior parameters are estimated from all the data. This leads to the name

"empirical Bayes estimation."

More sophisticated methods account for the variability in the estimators a and b. In particular, Kass and Steffey (1989)(Ref [4]) give a simple first-order correction, which RADS applies to the beta-binomial model. This approach leaves each plant-specific mean unchanged but lengthens the interval somewhat.

RADS gives the overall distribution, beta(a, b), with its mean and a 90% interval corresponding to the 5th and 95 percentiles. RADS also gives the plant-specific means and 90% intervals. The plant-specific distributions are approximated by beta distributions, but after the Kass-Steffey adjustment the plant-specific distribution parameters do not correspond to simple updating of a single prior distribution with the plant-specific data. For more information, see Atwood (1994) (Ref 3) .

Empirical Bayes Estimation of Lambda

Suppose that the data for and event frequency have been

partitioned into distinct data sources, such as distinct plants or systems.

For concreteness, the model is explained here assuming that the distinct data

sources are plants. Each data source corresponds to an observed exposure time,

say ![]() hours for the ith

plant. The number of events for that plant is assumed to be a Poisson(λti)

random variable.

hours for the ith

plant. The number of events for that plant is assumed to be a Poisson(λti)

random variable.

Suppose that l is believed to vary from plant to plant. For example, the chi-square test may have rejected the hypothesis of a constant l, or engineering considerations may suggest that l is not constant. What model should be used?

One approach is to analyze each plant separately, resulting in a separate estimate of l for each plant. This is reasonable if there are only two plants. It might also be reasonable if one plant is clearly different from all the others. In this case, the one plant could be analyzed separately, and all the other plants might be considered as a single homogeneous source. After this regrouping of the data, only two data sources exist, to be analyzed separately.

Often, however, removal of one outlier leaves a data set that contains another outlier, and removal of that may leave a set with still another outlier. In such cases it is simpler (that is, it involves fewer parameters to estimate) to use the following compound model.

The method models the variation between the plants. It is

assumed that l varies from plant

to plant, and follows a gamma (a, b) distribution.

Let ![]() denote the value

corresponding to the ith plant. At this plant, it is

assumed that events occur randomly with frequency

denote the value

corresponding to the ith plant. At this plant, it is

assumed that events occur randomly with frequency ![]() . In short, the

number of failures in time t at the ith plant

is Poisson

. In short, the

number of failures in time t at the ith plant

is Poisson![]() ; the number of

failures in time t demands at a single random plant has a

gamma-Poisson(t, a, b) distribution. The value of t

is known, and the two parameters a and b are unknown.

; the number of

failures in time t demands at a single random plant has a

gamma-Poisson(t, a, b) distribution. The value of t

is known, and the two parameters a and b are unknown.

RADS uses numerical iteration to find the maximum likelihood estimates of a and b.

The iterative procedure does not always converge. In some cases, the search for the maximum likelihood leads to a/b stabilizing at a finite value but b diverging to infinity. RADS stops the numerical search whenever b appears to be larger than the total exposure time in the data set; such a large value for b should not be used because it would result in plant-specific intervals shorter than the interval based on simply pooling all the data. In this case RADS states that the empirical Bayes distribution is degenerate, concentrated at a single point.

Suppose now that finite values of a and b have

been estimated, giving an estimated overall distribution of l. We now naturally inquire about the

value of ![]() at the ith

plant. The model says that

at the ith

plant. The model says that ![]() was randomly selected

from the gamma(a, b) distribution, and the

was randomly selected

from the gamma(a, b) distribution, and the ![]() events in time

events in time ![]() were generated from a

Poisson

were generated from a

Poisson![]() distribution. Recall

that a and b are estimated. The simplest approach is to act as

if the estimates were the true values. For the ith

data source, let the prior distribution of

distribution. Recall

that a and b are estimated. The simplest approach is to act as

if the estimates were the true values. For the ith

data source, let the prior distribution of ![]() be beta(a, b),

and find the posterior distribution of

be beta(a, b),

and find the posterior distribution of ![]() by updating the prior

with the data. This is the usual Bayes method for

estimating

by updating the prior

with the data. This is the usual Bayes method for

estimating ![]() , except that the

prior parameters are estimated from all the data. This leads to the name

"empirical Bayes estimation."

, except that the

prior parameters are estimated from all the data. This leads to the name

"empirical Bayes estimation."

More sophisticated methods account for the variability in the estimators a and b. In particular, Kass and Steffey (1989) (Ref 5) give a simple first-order correction, which RADS applies to the gamma-Poisson model. This approach leaves each plant-specific mean unchanged but lengthens the interval somewhat.

RADS gives the overall distribution, gamma(a, b), with its mean and a 90% interval corresponding to the 5th and 95 percentiles. RADS also gives the plant-specific means and 90% intervals. The plant-specific distributions are approximated by gamma distributions, but after the Kass-Steffey adjustment the plant-specific distribution parameters do not correspond to simple updating of a single prior distribution with the plant-specific data. For more information, see Engelhardt (1994) (Ref 3).

Trending

Estimating a Trend in p

Model of trend

The model is the same as when estimating a failure probability (see also Bayesian Estimation of p), except now the probability p depends on time, t. Thus, the model assumptions are

1. A demand at time t results in a failure with some probability p(t), and a success with probability 1 - p(t).

2. Occurrences of failures on different demands are statistically independent.

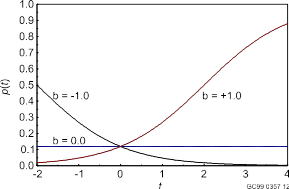

By far the most commonly used functional form for p(t) is the logit model, in which ln{ p(t)/[1 - p(t)] } is a simple function of unknown parameters. Fitting such a model to data is sometimes called logistic regression. RADS uses this model, and fits

ln{ p(t)/[1 - p(t)] } = a + bt .

This function of p has a name, the logit function. Therefore, the above equation could be written

logit[p(t)] = a + bt .

A frequently used relation is that

y = logit[p(t)] / ln{ p(t)/[1 ! p(t)] }

is equivalent to

p(t) = logit![]() (y) /

(y) / ![]() ,

,

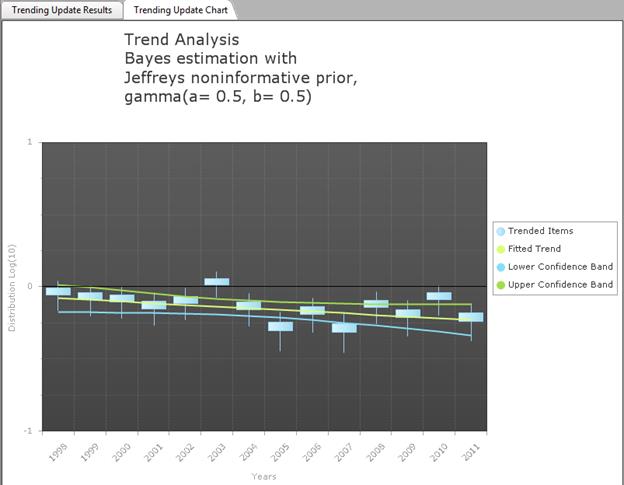

denoting the inverse function of the logit by logit-1. The figure below shows p(t) as a function of t, where logit[p(t)] = a + bt, with a = 0.1 and several values of b. Notice that the value of p(t) stays between 0.0 and 1.0, as it should.

The parameters have simple interpretations: a is the value of the logit of p when t = 0, and b is the slope of the logit of p.

The model assumes that logit[p(t)] = a + bt . Therefore, one might decide simply to use least-squares software as follows. First, estimate p for each bin, based on only the data for that bin:

![]() .

.

Then fit logit![]() to

to ![]() by least squares.

The same problems must be addressed that are mentioned for fitting a rate l.

by least squares.

The same problems must be addressed that are mentioned for fitting a rate l.

First, if any observed failure count, ![]() , equals either 0 or

the demand count ni, then

, equals either 0 or

the demand count ni, then ![]() will be 0.0 or 1.0

for that bin, and the logit will be undefined. RADS offers three choices.

will be 0.0 or 1.0

for that bin, and the logit will be undefined. RADS offers three choices.

1.

Estimate

![]() by

by ![]() , the MLE. This method fails if

, the MLE. This method fails if

![]() = 0 or

= 0 or ![]() = ni for any bin, because

then logit

= ni for any bin, because

then logit![]() is undefined.

is undefined.

2.

Instead

of estimating ![]() by

by ![]() , use

, use ![]() . This is equivalent

to replacing the MLE by the posterior mean based on the Jeffreys noninformative prior.

. This is equivalent

to replacing the MLE by the posterior mean based on the Jeffreys noninformative prior.

3.

Estimate

![]() by the posterior mean

based on the constrained noninformative prior. In this case, the constraint is that

the prior mean equals

by the posterior mean

based on the constrained noninformative prior. In this case, the constraint is that

the prior mean equals ![]() . This is the default

method.

. This is the default

method.

Such ways tend to reduce the trend slightly, because they add a constant to all the failure and demand counts, slightly flattening out any original differences. Using a constrained noninformative prior has a smaller such effect than using the Jeffreys prior.

The second point that must be considered is that the

variance of the estimator of p is not constant. Therefore, the

following iteratively reweighted least-squares method can be used. Assume that

p in the ith bin is estimated by ![]() . If the simple MLE

is used, then a and b are both zero. If method 1 above is

used, then a = 2 and b = 2.

If method 2 above is used, then a

and b must be found from a table

for the constrained noninformative prior. Neter and Wasserman (1974, Eq.

(9.51)) (Ref 5) state that the asymptotic variance of logit[MLE of

. If the simple MLE

is used, then a and b are both zero. If method 1 above is

used, then a = 2 and b = 2.

If method 2 above is used, then a

and b must be found from a table

for the constrained noninformative prior. Neter and Wasserman (1974, Eq.

(9.51)) (Ref 5) state that the asymptotic variance of logit[MLE of ![]() ] is

] is

![]()

The method given here is a generalization when a and b

are not both zero, setting the weight ![]() to the inverse of the

asymptotic variance of the estimator.

to the inverse of the

asymptotic variance of the estimator.

Begin by assuming that p is constant, and let ![]() be some simple

estimate of p, the same for all i. Fit

be some simple

estimate of p, the same for all i. Fit

![]()

to a straight line with weighted least squares, and weights

![]() .

.

Calculate the resulting estimates of ![]() ,

,

![]() .

.

Recalculate the weights with these estimates, and refit the data to a straight line using weighted least squares. Repeat this process until the estimates stabilize.

The final point is that least-squares fitting typically

assumes that the data are approximately normally distributed around the

straight line. In the present context, this means that logit(![]() ) is assumed to be

approximately normally distributed. This assumption is acceptable, unless the

total number of failures is close to zero or to the total number of demands.

However, the variance of the normal distribution is then estimated from the

scatter around the fitted line. This differs from typical treatment of

binomial data, where the mean determines the variance.

) is assumed to be

approximately normally distributed. This assumption is acceptable, unless the

total number of failures is close to zero or to the total number of demands.

However, the variance of the normal distribution is then estimated from the

scatter around the fitted line. This differs from typical treatment of

binomial data, where the mean determines the variance.

A 90% confidence interval for p(t) at a particular t is given by

![]() (1)

(1)

Where ![]() is the 95th percentile

of Students t distribution with df degrees of freedom.

is the 95th percentile

of Students t distribution with df degrees of freedom.

The above confidence interval

is for a particular t. For many values of t, many such confidence

intervals could be calculated. Each is a valid confidence interval, but they

are not simultaneously valid. This is a subtle point. To appreciate it,

recall the interpretation of the 90% confidence

interval for l(t) for

some particular time ![]() :

:

Pr[confidence interval for p(![]() contains true

occurrence rate at time

contains true

occurrence rate at time ![]() ] = 0.90. (2)

] = 0.90. (2)

Here, the data set is thought of as random. If many data

sets could be generated from the same set of years, each data set would allow

the calculation of a confidence interval for ![]() , and 90% of these

confidence intervals would contain the true occurrence rate.

, and 90% of these

confidence intervals would contain the true occurrence rate.

A similar confidence statement applies to each time. The simultaneous statement would involve

Pr[confidence

interval for p(![]() contains true

occurrence rate at time

contains true

occurrence rate at time ![]() AND

AND

confidence

interval for p(![]() contains true

occurrence rate at time

contains true

occurrence rate at time ![]() AND

AND

so forth ]. (3)

This probability is hard to quantify, because the intervals are all calculated from the same data set, and thus are correlated. However, Expression (3) is certainly smaller than 0.90, because the event in square brackets in Expression (3) is more restrictive that the event in brackets in Eq. (2).

This problem is familiar in the context of least squares

fitting. For example, Neter and Wasserman (1974) (Ref 5) discuss it, and attribute the solution to Working, Hotelling, and Scheffé. A simultaneous 90%

confidence band has the same form as (1), but the multiplier ![]() is replaced by

is replaced by

![]() ,

,

Where ![]() is the 90th

percentile of the F distribution with 2 and df degrees of

freedom. RADS gives a plot of the fitted trend and of the simultaneous

confidence band for the trend line.

is the 90th

percentile of the F distribution with 2 and df degrees of

freedom. RADS gives a plot of the fitted trend and of the simultaneous

confidence band for the trend line.

For better or worse, this method does not use the assumption that the counts in each bin are binomially distributed. It instead uses the assumption that the estimated frequency for each bin is approximately logistic-normally distributed.

Test for presence of trend

Let the two hypotheses be defined by

Ho: p(t) is constant

![]()

The null hypothesis Ho is false if and only if b is nonzero. Therefore, the test of Ho is the same as a test that b = 0. This test is carried out, based on the estimate of b and the standard error of the estimate, and the assumption that the points being fitted have approximately normal scatter around the trend line. RADS reports the result of this test.

Model Validation

RADS constructs a weighted sum of squares that should have approximately a chi-squared distribution if the model assumptions are valid. A very large value is evidence that the model does not fit the data well. RADS calculates the p-value for lack of fit, the probability that the sum of squares would be as large as observed or larger, if the model assumptions are valid.

In addition, RADS reports a "standardized residual" for each bin. (The above sum of squares equals the sum of the squared standardized residuals.) Examination of the standardized residuals can help show which bins, if any, are contributing most heavily to lack of fit.

If the weighted sum of squares is in the right tail of the chi-squared distribution, such as beyond the 95th percentile, this is evidence of lack of fit. One common causes of lack of fit is systematic variation C the assumed form of the model is incorrect. That means that logit[p(t)] is not of the form a + bt. Another possible cause is extra-Poisson variance, additional sources of variation that are not accounted for in the Poisson model. To gain insight as to which contributors to lack of fit seem to be present, examine the standardized residuals, and the plot given by RADS. Look to see if the variation appears to be systematic or random.

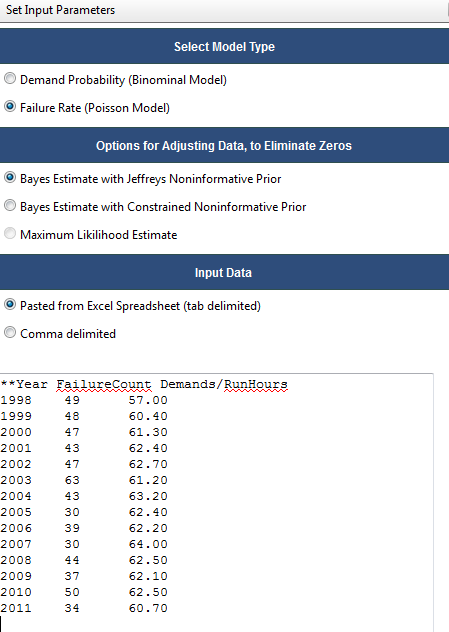

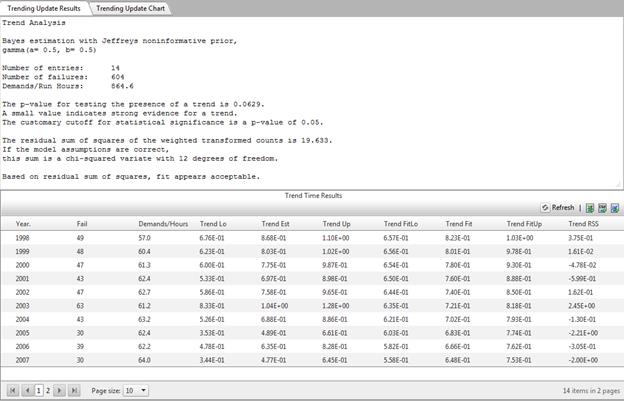

Estimating a Trend in Lambda

Model of trend

This model is the same as when estimating an event frequency lambda (see Frequentist Estimation of Lambda, and Bayesian Estimation of Lambda), except now the frequency l depends on time t. The setting is that one or more similar components or systems are observed over time, and that events, such as failures occur randomly. Suppose the following.

1. The probability of an event in a time interval of length Dt approaches 0 as Dt ® 0. This assumption says that the probability of an event occurring in any short interval (t, t + Dt) is approximately l(t)Dt for some function of t, l(t).

2. Exactly simultaneous events do not occur.

3. Event occurrences in disjoint time periods are independent.

The assumed model is an extension of the model for a homogeneous Poisson process.

RADS considers two important special cases.

1. l(t) = a constant > 0. In this case, the constant is denoted l.

2. l(t) = exp(a + bt), where t measures time and a and b are unknown parameters, which must be estimated from the data. This is called a loglinear model, because lnl(t) = a + bt. It is also called the exponential event rate model. Here, b has units 1/time.

In the second case, l(t) is increasing if b is positive and decreasing if b is negative. If b equals 0, the model reduces to the first case, with constant l. Tests for trend are formulated as tests of whether b = 0. Note also that the occurrence rate is positive in both cases.

The interpretation of a is the intercept of lnl(t), that is, the value of l(t) at t = 0. The meaning of a depends on how time is coded. The time period for the data is divided into bins. Typically, RADS codes time so that the first data bin corresponds to t = 1.

Estimation

The bins must be small enough that l(t) is approximately a

straight-line function within each bin, not strongly curved within the bin.

Denote the midpoint of the ith bin by ![]() . Then the expected

number of events in the bin is approximately

. Then the expected

number of events in the bin is approximately ![]() , where

, where ![]() is the exposure time for the bin. The method is to fit

the observed counts

is the exposure time for the bin. The method is to fit

the observed counts![]() , to

, to ![]() , while assuming that

, while assuming that ![]() has some parametric

form.

has some parametric

form.

Since the model assumes

ln(l(t)) = a + bt

it would seem simple to use least-squares software as follows. First, estimate l in each bin based only on the data for that bin:

![]()

Then fit ln![]() to

to ![]() by least squares. In

principle, this works. In practice, the method has several twists in the road,

described next.

by least squares. In

principle, this works. In practice, the method has several twists in the road,

described next.

First, if the observed count is zero in any bin, ![]() will be zero for that

bin, and the logarithm will be undefined. RADS offers the user three choices

will be zero for that

bin, and the logarithm will be undefined. RADS offers the user three choices

1.

Estimate

![]() by

by ![]() , the MLE. This method fails if

any

, the MLE. This method fails if

any ![]() is zero, because ln(0)

is undefined.

is zero, because ln(0)

is undefined.

2.

Estimate

![]() by

by ![]() . This is equivalent

to replacing the MLE by the posterior mean based on the Jeffreys noninformative prior.

. This is equivalent

to replacing the MLE by the posterior mean based on the Jeffreys noninformative prior.

· Estimate ![]() by the posterior mean

based on the constrained noninformative prior.

In this case, the constraint is that the prior mean equals

by the posterior mean

based on the constrained noninformative prior.

In this case, the constraint is that the prior mean equals ![]() . This is the default

method.

. This is the default

method.

Such ways tend to reduce the trend slightly, because they add a constant to all the event counts, slightly flattening out any original differences. Using a constrained noninformative prior has a smaller such effect than using the Jeffreys prior.

The second point that must be considered is that the

variance of ![]() is not constant. For

simplicity, this issue will be explained for the case with no zero counts, and

ln(

is not constant. For

simplicity, this issue will be explained for the case with no zero counts, and

ln(![]() estimated by ln

estimated by ln![]() = ln(

= ln(![]() ).

).

The variance of ln(![]() ) is approximately the

relative variance of

) is approximately the

relative variance of ![]() , which is

, which is

![]()

If ![]() has a Poisson

has a Poisson![]() distribution.

Ordinary least-squares fitting has some optimality properties if the variance

is constant. Otherwise, it is more efficient to use weighted least squares,

with weights inversely proportional to the variances of the observations.

distribution.

Ordinary least-squares fitting has some optimality properties if the variance

is constant. Otherwise, it is more efficient to use weighted least squares,

with weights inversely proportional to the variances of the observations.

Unfortunately, the variances depend on the ![]() values, which are

unknown. Therefore, the following iteratively reweighted least-squares

method is used. Begin by assuming that l

is constant, and fit ln(

values, which are

unknown. Therefore, the following iteratively reweighted least-squares

method is used. Begin by assuming that l

is constant, and fit ln(![]() ) to a straight line

with weighted least squares, and weights

) to a straight line

with weighted least squares, and weights ![]() . Calculate the

resulting estimates of

. Calculate the

resulting estimates of ![]() ,

,

![]() .

.

Then refit the data to a straight line, using weighted

least squares, and weights ![]() . Repeat this process

until the estimates stabilize.

. Repeat this process

until the estimates stabilize.

The final point is that least-squares fitting typically

assumes that the data are approximately normally

distributed around the straight line. In the present context, this

means that ln(![]() ) is assumed to be

approximately normally distributed. This assumption is acceptable, unless the

mean count is close to zero. However, the variance of the normal distribution

is then estimated from the scatter around the fitted line. This differs from

the typical treatment of Poisson data, where the mean determines the variance.

) is assumed to be

approximately normally distributed. This assumption is acceptable, unless the

mean count is close to zero. However, the variance of the normal distribution

is then estimated from the scatter around the fitted line. This differs from

the typical treatment of Poisson data, where the mean determines the variance.

A 90% confidence interval for l(t) at a particular t is given by

![]() . (1)

. (1)

Here ![]() is the 95th percentile

of Student=s

t distribution with df degrees of freedom.

is the 95th percentile

of Student=s

t distribution with df degrees of freedom.

The above confidence interval

is for a particular time t. For many values of t, many such

confidence intervals could be calculated. Each is a valid confidence interval,

but they are not simultaneously valid. This is a subtle point. To appreciate

it, recall the interpretation of the 90% confidence interval for ![]() for some particular

time

for some particular

time ![]() :

:

Pr[confidence

interval for ![]() contains true

occurrence rate at time

contains true

occurrence rate at time ![]() ] = 0.90. (2)

] = 0.90. (2)

Here, the data set is thought of as random. If many data

sets could be generated from the same set of years, each data set would allow

the calculation of a confidence interval for ![]() , and 90% of these confidence intervals would contain the true

occurrence rate.

, and 90% of these confidence intervals would contain the true

occurrence rate.

A similar confidence statement applies to each time. The simultaneous statement would involve

Pr[confidence

interval for ![]() contains true

occurrence rate at time

contains true

occurrence rate at time ![]() AND

AND

confidence

interval for ![]() contains true

occurrence rate at time

contains true

occurrence rate at time ![]() AND

AND

so forth ]. (3)

This probability is hard to quantify, because the intervals are all calculated from the same data set, and thus are correlated. However, Expression (3) is certainly smaller than 0.90, because the event in square brackets in Expression (3) is more restrictive that the event in brackets in Eq. (2).

This problem is familiar in the context of least squares

fitting. For example, Neter and Wasserman (1974)

(Ref [5]) discuss it, and attribute the

solution to Working, Hotelling, and Scheffé. A simultaneous 90% confidence

band has the same form as (1), but the multiplier ![]() is replaced by

is replaced by

![]() ,

,

where ![]() is the 90th percentile

of the F distribution with 2 and df

degrees of freedom. RADS gives a plot of the fitted trend and of the

simultaneous confidence band for the trend line.

is the 90th percentile

of the F distribution with 2 and df

degrees of freedom. RADS gives a plot of the fitted trend and of the

simultaneous confidence band for the trend line.

For better or worse, this method does not use the assumption that the counts in each bin are Poisson distributed. It instead treats the estimated frequency for each bin as approximately lognormally distributed.

Test for presence of trend

Let the two hypotheses be defined by

Ho: l(t) is constant

H1: l(t) = exp(a + bt), b ¹ 0

The null hypothesis Ho is false if and only if b is nonzero. Therefore, the test of Ho is the same as a test that b = 0. This test is carried out, based on the estimate of b and the standard error of the estimate, and the assumption that the points being fitted have approximately normal scatter around the trend line. RADS reports the result of this test.

Model Validation

RADS constructs a weighted sum of squares that should have approximately a chi-squared distribution if the model assumptions are valid. A very large value is evidence that the model does not fit the data well. RADS calculates the p-value for lack of fit, the probability that the sum of squares would be as large as observed or larger, if the model assumptions are valid.

In addition, RADS reports a "standardized residual " for each bin. (The above sum of squares equals the sum of the squared standardized residuals.) Examination of the standardized residuals can help show which bins, if any, are contributing most heavily to lack of fit.

If the weighted sum of squares is in the right tail of the chi-squared distribution, such as beyond the 95th percentile, this is evidence of lack of fit. One common causes of lack of fit is systematic variation ¾ the assumed form of the model is incorrect. That means that lnl(t) is not of the form a + bt. Another possible cause is extra-Poisson variance, additional sources of variation that are not accounted for in the Poisson model. To gain insight as to which contributors to lack of fit seem to be present, examine the standardized residuals, and the plot given by RADS. Look to see if the variation appears systematic or random.

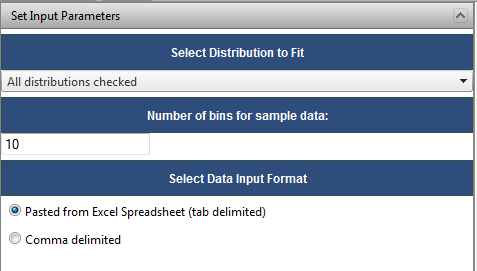

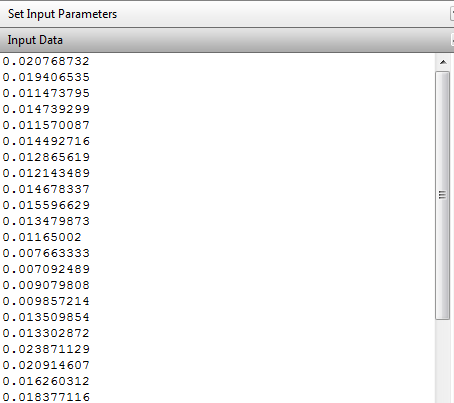

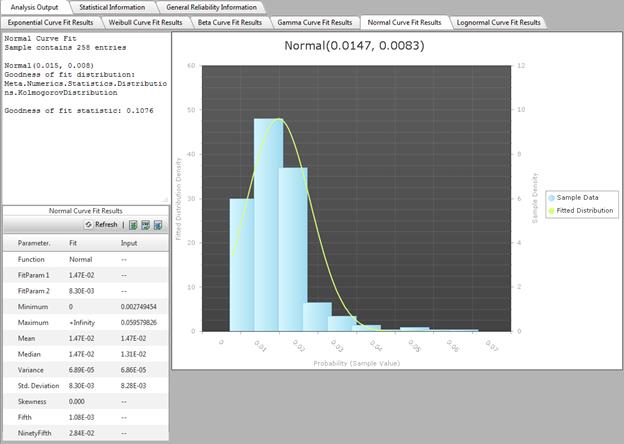

Curve Fitting

The RADS Calculator implements a limited curve fitting capability for data samples (in a single column of data to be fit). Enter the data manually with a return after each entry or copy and paste from Excel (tab delimited).

Select which distributions to fit the data to (‘All Distributions’ is the default).

The number of bins for the sample data only affects the plotting of the data and defaults to 10.

Once the curve fit has been executed, the curve fit results tabs that succeeded (sometimes the curve fitting routine cannot fit the data to the specified curve) will be enabled. The text box provides the parameters of the fitted distribution and a Goodness of Fit Statistic. The larger the Goodness of Fit Statistic, the better the fit.

The grid shows the full range of fitted distribution parameters and the input parameters. The plot shows the binned sample data and the fitted distribution.

The curve fitting routines are provided by a mathematical package named Meta.Numerics. The results have been validated using @Risk and are comparable to those results.

Distributions

Beta distribution

The beta distribution is most commonly used as a Bayes distribution to model uncertainty in a parameter p. The density is

![]() for 0 < p<

1

for 0 < p<

1

For most applications the gamma functions in the front can be ignored ¾ they only form a normalizing constant, to ensure that the density integrates to 1. The important feature of the density is that

![]() ,

,

where the symbol µ denotes “is proportional to.” The parameters of the distribution, a and b, must both be positive. The shape of the beta density depends on the size of the two parameters. If a < 1, the exponent of p is negative in equation for the density, and therefore the density is unbounded as p ® 0. Likewise, if b < 1, the density is unbounded as p ® 1. If both a > 1 and b > 1, the density is roughly bell shaped, with a single mode.

The mean and variance of the distribution are:

mean, denoted m here, = a/(a + b)

variance = m(1 - m)/(a + b + 1).

The formula for the variance shows that as the sum a + b becomes large, the variance becomes small, and the distribution becomes more tightly concentrated around the mean. Although the moments are algebraic functions of the parameters, the percentiles are not so easily found. RADS finds the percentiles of a beta distribution using rather elaborate numerical calculations.

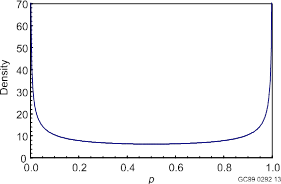

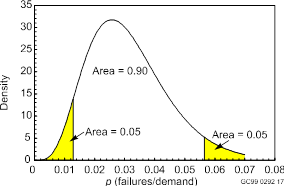

Two beta distributions are plotted below.

Beta(0.5, 0.5) density. This is the Jeffreys noninformative prior distribution for p.

Beta(5.2, 160.1) density, with 5th and 95th percentiles shown. The mean is 5.2/(5.2+160.1) = 0.0315, and the standard deviation is [0.0315(1 - 0.0315)/(5.2 + 160.1 + 1)]1/2 = 0.0135.

The beta distributions form the conjugate family for binomial data. That is, suppose that independent failures and successes are observed, with Pr(failure) = p on each demand. Denote the total number of failures by x and the total number of demands by n. If the prior distribution for p is a beta distribution with parameters aprior and bprior , then the posterior distribution is also a beta distribution, with

aposterior = aprior + x

bposterior = bprior + (n - x) .

This gives an intuitive interpretation for the prior parameters: aprior is to the effective number of failures in the prior information, and bprior is the effective number of successes in the prior information.

RADS allows a beta distribution to be specified by entering any two of: a, b, and m. RADS then calculates and displays the third value.

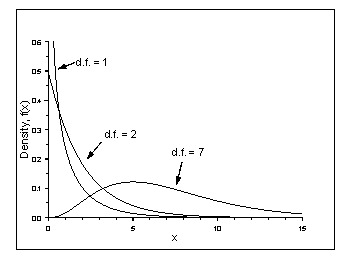

Gamma distribution

The gamma distribution has many uses. An important use in RADS is as a Bayes prior distribution for a frequency l. For this application, the most convenient parameterization is

![]() for l > 0 .

for l > 0 .

For most applications the terms that do not involve l can be ignored ¾ they only form a normalizing constant, to ensure that the density integrates to 1. The important feature of the density is that

![]()

where the symbol µ denotes “is proportional to.” The parameters of the distribution, a and b, must both be positive.

Some references use other letters for the parameters a and b, and in some applications it is more convenient to parameterize in terms of b¢ = 1/b. The two parameters must both be positive. Here l has units 1/time and q has units of time, so the product lq is unitless. For example, if l is the frequency of events per critical-year, q has units of critical-years. The parameter q corresponds to the scale of l C if we convert l from 1/hours to 1/years by multiplying it by 8760, we correspondingly divide q by 8760, converting it from hours to years. The other parameter, a, is unitless, and is called the shape parameter. The gamma function, G(a), is a standard mathematical function; if a is a positive integer, G(a) equals (a!1)!

The shape of the gamma density depends on the first parameter. If a < 1, the exponent of l is negative in the equation for the density, and therefore the density is unbounded as l ® 0. If a > 1, the density is roughly bell shaped (though skewed to the right), with a single mode. As a ® ¥, the density becomes symmetrical around the mean.

The mean and variance of the distribution are:

mean = a/q

variance = a/q2.

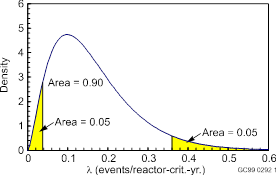

Note that the units are correct, units 1/time for the mean and 1/time2 for the variance. The percentiles of the gamma distribution are calculated by RADS using numerical algorithms. A typical gamma density is plotted below.

Gamma density with a = 2.53 and b = 15.52 reactor-critical-years. The 5th and 95th percentiles are also shown.

The gamma distributions form a conjugate family for Poisson data. That is, suppose that events occur independently of each other in time, with Pr(an event occurs in time interval of length Dt) » lDt. Let x be the number of events observed in a time period of length t. If l has a gamma prior distribution with parameters aprior and bprior, then the posterior distribution is also a gamma distribution, with

aposterior = aprior + x

bposterior = bprior + t .

This gives an intuitive interpretation for the prior parameters: aprior is to the effective number of events in the prior information, and bprior is the corresponding effective time period in the prior information.

One “distribution” that is often used is the Jeffreys noninformative prior, defined for events in time as a gamma(0.5, 0) distribution. In fact, this is not a distribution, because the second parameter is not positive. Ignoring that problem and taking the limit of a gamma(a, b) density as b ® 0, the density is seen to be proportional to

![]() .

.

This function does not have a finite integral. Therefore, it is not a density, and cannot be made into a density by multiplication by some suitable normalizing constant. It is called an “improper distribution.” Nevertheless, it may be treated as a density in formal algebraic calculations given above, yielding

aposterior = aprior + x = x + 0.5

bposterior = bprior + t = t + 0 = t .

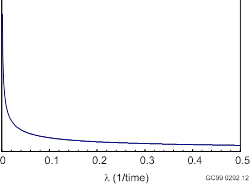

The Jeffreys noninformative prior distribution is plotted below.

Jeffreys noninformative prior distribution for l, defined as l-1/2 .

RADS allows a gamma distribution to be specified by the α parameter, which is also known as r.

Normal distribution

The normal distribution is not used directly by RADS, but it is used indirectly, in calculations with the lognormal or logistic-normal distributions.

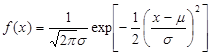

X is normally distributed with mean m and variance s2 if its density is of the form

.

.

The parameter m can have any value, and the parameter s must be positive. This density is positive for all x, positive and negative. That is, a normally distributed random variable can take any value, positive or negative.

The mean of the distribution is m and the variance is s2. Percentiles or probabilities involving X can be found from a table of the standard normal distribution, that is, the normal distribution with mean 0 and variance 1. This is done using the following fact. If X has a normal(m, s2) distribution, then (X - m)/s has a normal(0, 1) distribution. For example, suppose that X is normal with m = -3.4 and m and s = 1.2, and the 95th percentile of X is needed. This is the number a such that Pr(X £ a) = 0.95. The desired number is found by solving

0.95 = Pr(X £ a)

Pr[(X - m)/s £ (a - m)/s ] performing the same algebra on both sides of the inequality

Pr[Z £ (a - m)/s] denoting (X - m)/s by Z, where Z is normal(0, 1)

Therefore, (a - m)/s must equal 1.645, because a table of the standard normal distribution shows that 1.645 is the 95th percentile of the distribution. Algebraic rearrangement then shows that

a = m + 1.645s .

Lognormal distribution

Y has a lognormal distribution if ln(Y) has a normal distribution. For use in formulas, denote ln(Y) by X here. Then Y = exp(X). X can take all real values, implying that Y can take all positive values. In Bayesian estimation, an event frequency, l, is sometimes given a lognormal prior distribution. A probability of failure, p, is also sometimes assigned a lognormal prior distribution, even though a lognormal variable can take all possible positive values and p must be £ 1. This conflict is of negligible importance if the lognormal distribution assigns almost all the probability to the interval from 0 to 1.

Let Y be lognormally distributed. That is X = ln(Y) has a normal(m, s2) distribution. The density of Y satisfies

.

.

It is important to note that this is not simply the normal density with lny substituted for x. A 1/y term is also present that does not correspond to anything in the normal density. [The 1/y term enters when (1/y)dy is used to replace dx, similar to the change-of-variables rule in calculus.]

The mean and variance of Y are

mean = exp(m + s2/2)

variance = exp(2m + s2)[exp(s2) - 1] .

The percentiles are obtained by direct translation from the normal distribution: qth percentile of Y = exp(qth percentile of X). In particular

median = exp(m)

95th percentile = exp(m + 1.645s)

5th percentile = exp(m - 1.645s) .

It follows that the error factor, defined as the ratio of the 95th percentile to the median, is

EF = exp(1.645s) .

RADS allows a lognormal distribution to be specified in several ways, according to which pair of inputs the user chooses to enter: either m and s, or the mean and error factor, or the median and error factor. Any of these pairs uniquely determines the distribution. RADS then calculates and displays the other values.

Logistic-normal distribution

The distribution of p has a logistic-normal distribution if ln[p/(1 - p)] has a normal distribution. The function ln[p/(1 - p)] is called the logit function of p. For use in formulas, denote ln[p/(1 - p)] by X here. Then p = exp(X)[1 + exp(X)]. X can take all real values, implying that p can take all values between 0 and 1. This makes the logistic-normal a natural prior distribution for a probability p, although it has not been widely used in PRA applications. If p is small with high probability, the term (1 - p) is usually close to 1, and logit(p) is usually close to ln(p). Therefore, the logistic-normal and lognormal distributions are nearly the same, unless p can take relatively large values (say 0.1 or larger) with noticeable probability.

The moments of the logistic-normal distribution apparently are not given by simple formulas. The percentiles, on the other hand, are obtained by direct translation from the normal distribution: qth percentile of p = exp(qth percentile of X)/{1 + exp(qth percentile of X)]. In particular

median = exp(m)/[1 + exp(m)]

95th percentile = exp(m + 1.645s)/[1 + exp(m + 1.645s)]

RADS allows a logistic-normal distribution to be specified in two ways, according to which pair of inputs the user chooses to enter: either m and s, or the median and 95th percentile. Either of these pairs uniquely determines the distribution. RADS then calculates and displays the other values.

Binomial distribution

The standard model for failures on demand assumes that the number of failures has a binomial distribution. The following assumptions lead to this distribution.

1. Each demand is a failure with some probability p, and is a success with probability 1 ! p.

2. Occurrences of failures for different demands are statistically independent; that is, the probability of a failure on one demand is not affected by what happens on other demands.

Under these assumptions, the number of failures, X, in some fixed number of demands, n, has a binomial(n, p) distribution,

![]()

where

![]() .

.

This distribution has two parameters, n and p, of which only the second is treated as unknown by RADS. The mean of the binomial(n, p) distribution is np, and the variance is np(1 - p).

Assumption 1 says that the probability of failure on demand is the same for every demand. If data are collected over a long time period, the assumption requires that the failure probability does not change or (less realistically) that the analyst does not care if it changes because only the average probability of failure on a random demand is needed. Likewise, if the data are collected from various plants, the assumption is that p is the same at all plants, or that the analyst does not care about between-plant differences but only about the industry average.

Assumption 2 says that the outcome of one demand does not influence the outcomes of later demands. Presumably, events at one plant have little effect on events at a different plant. However, the experience of one failure might cause a change in procedures or design that reduces the failure probability on later demands at the same plant. The binomial distribution assumes that such effects are negligible.

RADS tries to check the data for violations of the assumptions. Thus, it looks for differences between plants or over time. If variation is seen between plants or between systems, RADS allows for a more general model, the empirical Bayes model. If variation is seen over time, RADS allows for modeling of a trend in p.

Poisson distribution

The standard model for events in time assumes that the event count has a Poisson distribution. The following assumptions lead to this distribution.

1. The probability that an event will occur in any specified short exposure time period is approximately proportional to the length of the time period. In other words, for an interval of length Dt the probability of an occurrence in the interval is approximately l H Dt for some l > 0.

2. Exactly simultaneous events do not occur.

3. Occurrences of events in disjoint exposure time periods are statistically independent.

Under the above assumptions, the number of occurrences X in some fixed exposure time t is a Poisson distributed random variable with mean m = lt,

![]() for x = 0,

1, 2, …

for x = 0,

1, 2, …

The parameter l is a rate or frequency. To make things clearer, the kind of event is often stated, that is, “initiating event rate” or “very-small-LOCA frequency.” Because the count of events during a fixed period is a unitless quantity, the mean number of occurrences m is also unitless. However, the rate l depends on the units for measuring time. In other words, the units of l are 1 per unit of time, such as 1/reactor-year or 1/component-hr.

This model is called a Poisson process. It is extremely simple, because it is completely specified by the exposure time, t, and the one unknown parameter, l. Assumption 1 implies that the rate l does not change, neither with a monotonic trend, nor cyclically, nor in any other way. Assumption 2 says that exactly simultaneous events do not occur. The only way that they could occur (other than by incredible coincidence) is if some synchronizing mechanism exists, a common cause. Therefore, the operational interpretation of Assumption 2 is that common-cause events do not occur. Assumption 3 says that the past history does not affect the present. In particular, occurrence of an event yesterday does not make the probability of another event tomorrow either more or less likely. This says that the events do not tend to occur too much in clusters, nor do they tend to be systematically spaced and evenly separated.

RADS tries to check the data for violations of the assumptions. Thus, it looks for differences between plants or over time. If variation is seen between plants or between systems, RADS allows for a more general model, the empirical Bayes model. If variation is seen over time, RADS allows for modeling of a trend in l.

The mean and variance of a Poisson(m) distribution are both equal to m.

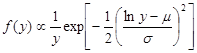

Chi-squared Distribution

The chi-squared distribution has many applications in statistics, and therefore is tabulated in most statistics books. In RADS it is used as an approximate distribution of the Pearson chi-squared statistic, valid for large sample sizes. It can also be used to calculate confidence intervals for event frequencies. The density depends on a single positive parameter, called the degrees of freedom. Several chi-squared densities are illustrated here, for different degrees of freedom.

Chi-squared densities with 1, 2, and 7 degrees of freedom.

The formula for a chi-squared density with n degrees of freedom is

, for x ³ 0.

The chi-squared distribution is a special case of a gamma distribution. Indeed, a table of the chi-squared distribution can be used to find probabilities for quantities having gamma distributions.

F Distribution

The F distribution can be used to find a confidence interval for a probability p. Mathematically, the F distribution can be developed as the distribution of the ratio of two random variables with chi-squared distributions. Therefore, the F distribution has two parameters, called the numerator (or first) degrees of freedom and the denominator (or second) degrees of freedom.

Many statistics books tabulate a few upper percentiles of the F distribution, such as the 95th and the 97.5th. Martz and Waller (1991) (Ref [6]) have the most complete tables, giving tables for selected percentiles from the 50th to the 99.5th.

Glossary

Bias. The difference between the expected value of an estimator and the true quantity being estimated. For example, if Y is a function of the data that estimates an unknown parameter q, the bias of Y is E(Y) - q.

Bin. A group of values of a continuous variable, used to partition the data into subsets. For example, event dates can be grouped so that each year is one bin, and all the events during a single year form a subset of the data.

c.d.f. cumulative distribution function, typically denoted F

Cell. When the data are expressed in a table of counts, a cell is the smallest element of the table. Each cell has an observed count and, under some null hypothesis, an expected count. Each cell can be analyzed on its own, and then compared to the other cells to see if the data show trends, patterns, or other forms of nonhomogeneity. In a 1 x J table, as with events in time, each cell corresponds to one subset of the data. In a 2 x J table, as with failures on demand, each data subset corresponds to two cells, one cell for failures and one for successes.

Confidence interval. In the frequentist approach, a 100p% confidence interval has a probability p of containing the true unknown parameter. This is a property of the procedure, not of any one particular interval. Any one interval either does or does not contain the true parameter. However, any random data set leads to a confidence interval, and 100p% of these contain the true parameter.

Conjugate. A family of prior distributions is conjugate, for data from a specified distribution, if a prior distribution in the family results in the posterior distribution also being in the family. A prior distribution in the conjugate family is called a conjugate prior. For Poisson data, the gamma distributions are conjugate. For binomial data, the beta distributions are conjugate.

Credibility interval. In the Bayesian approach, a 100p% credibility interval contains 100p% of the Bayesian probability distribution. For example, if q has been estimated by a posterior distribution, the 5th and 95th percentiles of this distribution contain 90% of the probability, so they form a (posterior) 90% credibility interval. It is not required to have equal probability in the two tails (5% in this example), although it is very common. For example, the interval bounded by 0 and the 90th percentile would also be a 90% credibility interval, a one-sided interval. Bayes credibility intervals have the same intuitive purpose as frequentist confidence intervals, but their definitions and interpretations are different.

Cumulative distribution function (c.d.f.). For a random variable X, the c.d.f. F(x) = Pr(X £ x). If X is discrete, such as a count of events, the c.d.f. is a step function, with a jump at each possible value of X. If X is continuous, such as a duration time, the c.d.f. is continuous.

Density. A function that is

integrated to yield a probability for a continuously distributed random

variable. If X has density f, then Pr(a £ X £

b) = ![]() . The

density f is related to the c.d.f. F by f(x) = F¢(x) and F(x) =

. The

density f is related to the c.d.f. F by f(x) = F¢(x) and F(x) = ![]() . The density is

sometimes referred to as the p.d.f., the probability density function.

. The density is

sometimes referred to as the p.d.f., the probability density function.

Duration. The time until something of interest happens, such as failure to run, recovery from a failure, restoration of offsite power, etc.

Estimate, estimator. In the frequentist approach, an estimator is a function of random data, and an estimate is the particular value taken by the estimator for a particular data set. That is, the term estimator is used for the random variable, and estimate is used for a number. The usual convention of using upper case letters for random variables and lower case letter for numbers is often ignored in this setting, so the context must be used to show whether a random variable or a number is being discussed.

Event rate. See failure rate for repairable systems, and replace the word “failure” by “event.”

Expected value. The mean, or average,

value of a random variable. If X is a discrete random variable, taking

values xi with probability f(xi) =

Pr(X = xi), the expected value of X is E(X)

= Si xif(xi).

If X is a continuously distributed random variable with density f,

the expected value of X is E(X) = ![]() . The expected value

of X is also called the expectation of X or the mean of X.

. The expected value

of X is also called the expectation of X or the mean of X.

Exposure time. The length of time during which the events of interest can possibly occur. The units must be specified, such as reactor-critical-years, site-calendar-hours, or system-operating-hours. Also called time at risk.

Failure on demand. Failure when a standby system is demanded, even though the system was apparently ready to function just before the demand. It is modeled as a random event, having some probability, but unpredictable on any one specific demand. Compare standby failure.

Failure rate. For a repairable system, the failure rate, l, is such that lDt is approximately the expected number of failures in a short time period from t to t + Dt. If simultaneous failures do not occur, lDt is also approximately the probability that a failure will occur in the period from t to t + lDt. In this setting, l is also called a failure frequency. For a nonrepairable system, lDt is approximately the probability that an unfailed system at time t will fail in the time period from t to t + lDt. In this setting, l is also called the hazard rate.